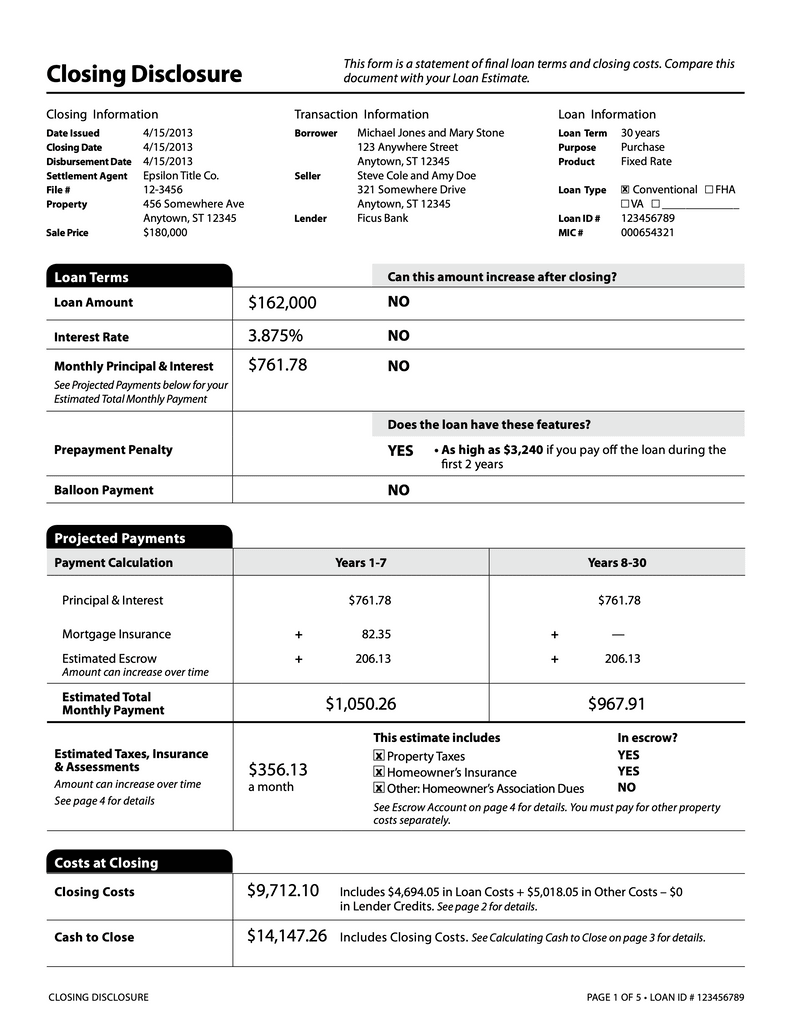

· According to the TILA-RESPA rule, creditorsmustretain a copy of the closingdisclosure and related documents for five years after the disclosure is made. This timeframe applies to both electronic and paper records, providing a standardized approach to record retention across the industry. Explore the TRID rule and uncover howlongcreditorsmustretain real estate loan records. Expand your knowledge of the law with TitleTap today. · Under the TILA-RESPA Integrated Disclosure (TRID) rule, which is basically the superhero cape that TRID wears to fight mortgage confusion, loan servicers are generally required to keep your ClosingDisclosure for a whopping three years from the date of consummation. HowLongMust A CreditorRetainTheClosingDisclosure? Curious about the importance of the ClosingDisclosure in real estate transactions? In this insightfu... HowLongMustCreditorsKeep Real Estate Loan Records? Under the TRID rule, creditorsmustretain Escrow Cancellation and Partial Payment Policy disclosures for two years; Loan Estimate records for three years after loan consummation and ClosingDisclosures for FIVE years. A creditor shall retain evidence of compliance with this part (other than advertising requirements under §§ 1026.16 and 1026.24, and other than the requirements under § 1026.19 (e) and (f)) for two years after the date disclosures are required to be made or action is required to be taken. · A creditormustretain evidence of compliance with § 1026.43 for three years after the date of consummation of a consumer credit transaction covered by that section.

how long must a creditor retain the closing disclosure video onlyfans leaked - Star Buzz

Tags:

PEOPLE

Leave a Comment